As an investor, this ratio helps evaluate a company against its competitors before making an investment decision. Related: What Is Asset Management? (With Career Options) Benefits For InvestorsĬompanies that maintain a high asset turnover ratio may garner more investments.

The company may then re-evaluate their finances and look for alternatives to maintain and improve its income through assets. A sudden drop in the ratio may indicate that one or more assets are losing their ability to generate income. When companies calculate the asset turnover ratio on a year-on-year basis, they monitor the revenue that an asset may lose due to depreciation. Related: What Is Decision Making? Definition, Types And Tips Monitor asset impairment It also enables businesses to explore new ways to generate an income using their current or fixed assets. They understand the returns on their assets and take calculated risks in their next purchase or expansion plans. Improve business decision makingĬomprehending the asset turnover ratio helps the management regulate their expenses.

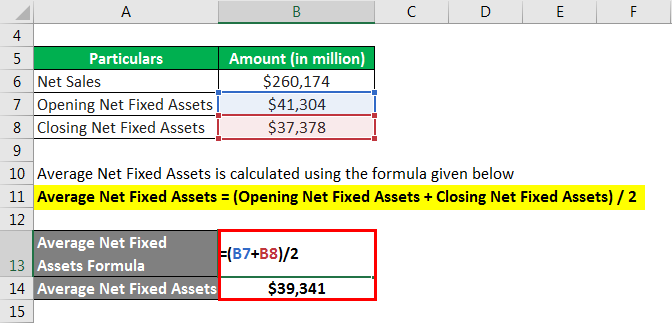

It also allows new and old companies to monitor their progress against their competitors. When multiple companies calculate this ratio, it helps set standards that the industry may follow. Due to this, a standard asset turnover ratio across sectors may seem unfair. Related: What Is A Business Valuation? (With Definition And Types) Sets industry standardsĮach industry progresses at different rates and has varied requirements. Financial analysts and investors use this ratio to determine their investment choices. It also reflects how well the company manages its resources and uses them to increase profits. It is an indicator of how the company is performing. Some of the advantages of understanding and evaluating this ratio are: Measure the company's performance Advantages Of Asset Turnover RatioĪnalysing the company's financial data to calculate the asset turnover ratio is highly beneficial. A positive year-on-year increase in the asset turnover ratio indicates the company gradually expands its capacity without generating losses. A higher ratio indicates the company is generating a high revenue on its investments. The asset turnover ratio is essential to understand how a company can maximise its return on every investment. Related: What Is Financial Modelling? (With Benefits And Types) Importance Of Asset Turnover Ratio It calculates the net sales as a percentage of the company assets, indicating the sales generated from the company assets. An asset turnover ratio is a ratio that determines how efficiently a company uses its assets to generate sales. It is the assets that a company owns with a potential for current or future economic benefit. Understanding the answer to "What is asset turnover ratio?" can help a company identify its assets to generate revenue. Please note that none of the companies, institutions or organisations mentioned in this article are associated with Indeed.

ASSET TURNOVER RATIO FORMULA YOUTUBE HOW TO

In this article, we discuss what is asset turnover ratio, understand how to calculate it, explore its benefits and find out some ways to improve it. Learning to calculate the asset turnover ratio helps make informed financial decisions. It sets industry standards for performance and helps companies monitor their expenses and maximise revenue using their assets. The asset turnover ratio helps financial analysts, investors and companies understand the organisation's growth over a few years.

0 kommentar(er)

0 kommentar(er)